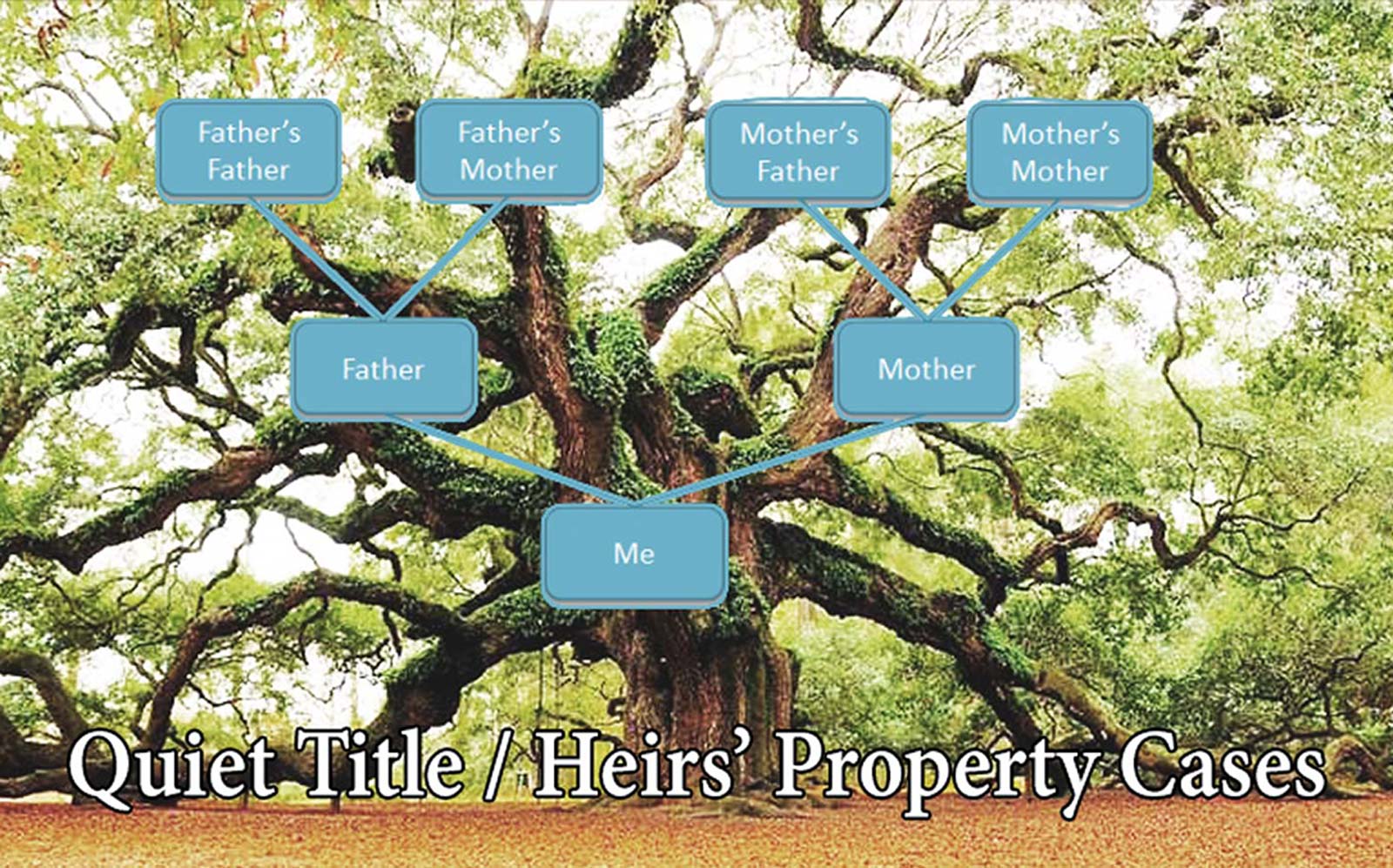

Quiet Title / Heirs' Property

If the title to a home or vacant parcel of land is not a good title the real property often cannot be sold, and certainly cannot be sold for what the property would be worth if it had a good title. A bad title is not marketable.

Property that is commonly referred to as “heirs’ property” does not have a good title because the transfer of the title cannot be documented from one family member to the next. A hint that property may be “heirs’ property” is that the real property tax bill is addressed to the “Estate of _______” or addressed to a person who is deceased.

Correcting a defect in title may require probating the Estate of a former owner who has died, or it could require the filing of a lawsuit to fix the bad title. A lawsuit to correct a title defect is called a “quiet title” action because the lawsuit legally determines ownership and settles (or “quiets”) all claims that anyone could assert to the title to the property.

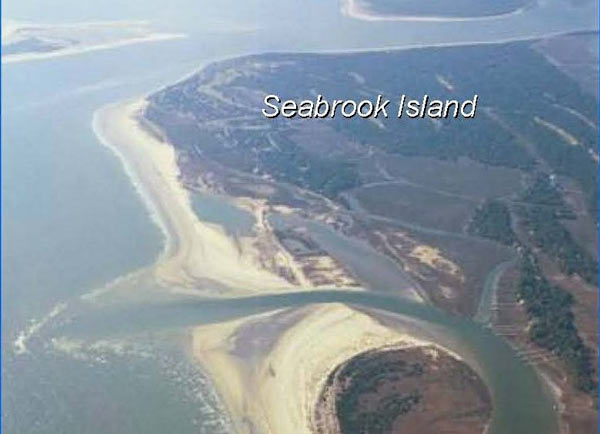

Mason Law Firm represented heirs to Seabrook Island

in their claim to valuable oceanfront property

If heirs’ property is involved, a quiet title action often determines that multiple family members each have an interest in the property. If there are multiple family members or heirs that own a parcel of real property, this gives rise to a number of legal issues. Such as, can the property be sold if all the family members do not agree? Who can use the property? Does everyone have to contribute to the payment of the taxes and property expenses? Can the property be subdivided? Who gets to make the decisions about what should happen with the property?

When real property is sold at a delinquent tax sale it is often necessary for the buyer to bring a quiet title action to establish that the tax sale was properly conducted and that no other person has an interest in the property other than the buyer at the tax sale. If the property was sold without proper notice, the persons who lost the property at the tax sale may have the ability to redeem the property. Property sold at a tax sale can be redeemed if the person whose property was sold for delinquent taxes acts promptly.

If you have a claim to heirs’ property, or you own a piece of property that has a title defect, or you have property that was involved in a delinquent tax sale, Mason Law Firm can assist you in taking appropriate legal action to assert your claim to the property and to correct title defects.